How to Discover Creative Financial Strategies in Australia

Identify Personal Financial Goals

Developing a clear vision of your financial aspirations is crucial for long-term planning. As a graphic designer, I compare my goals to creating a design project. First, you need a creative and inspired approach, much like setting realistic financial objectives. Consider what you aim to achieve—maybe it's about saving enough to open your own design studio or simply having the financial freedom to take on more adventurous artistic projects in Melbourne, such as participating in exhibits at the National Gallery of Victoria compare savings accounts.

Setting Realistic Financial Objectives

Start by breaking down your ambitions into manageable targets. Think about setting short, medium, and long-term goals. For instance, building an emergency fund might be a short-term goal, while investing in space for a collaborative studio could be a long-term goal.

Prioritising Financial Needs Over Wants

In an industry full of possibilities, it's easy to be distracted by creative wants. However, it’s critical to differentiate between what’s essential and what’s a luxury. To address needs effectively, consider using a term deposit calculator to assess how disciplined saving can help achieve these essentials term deposit calculator.

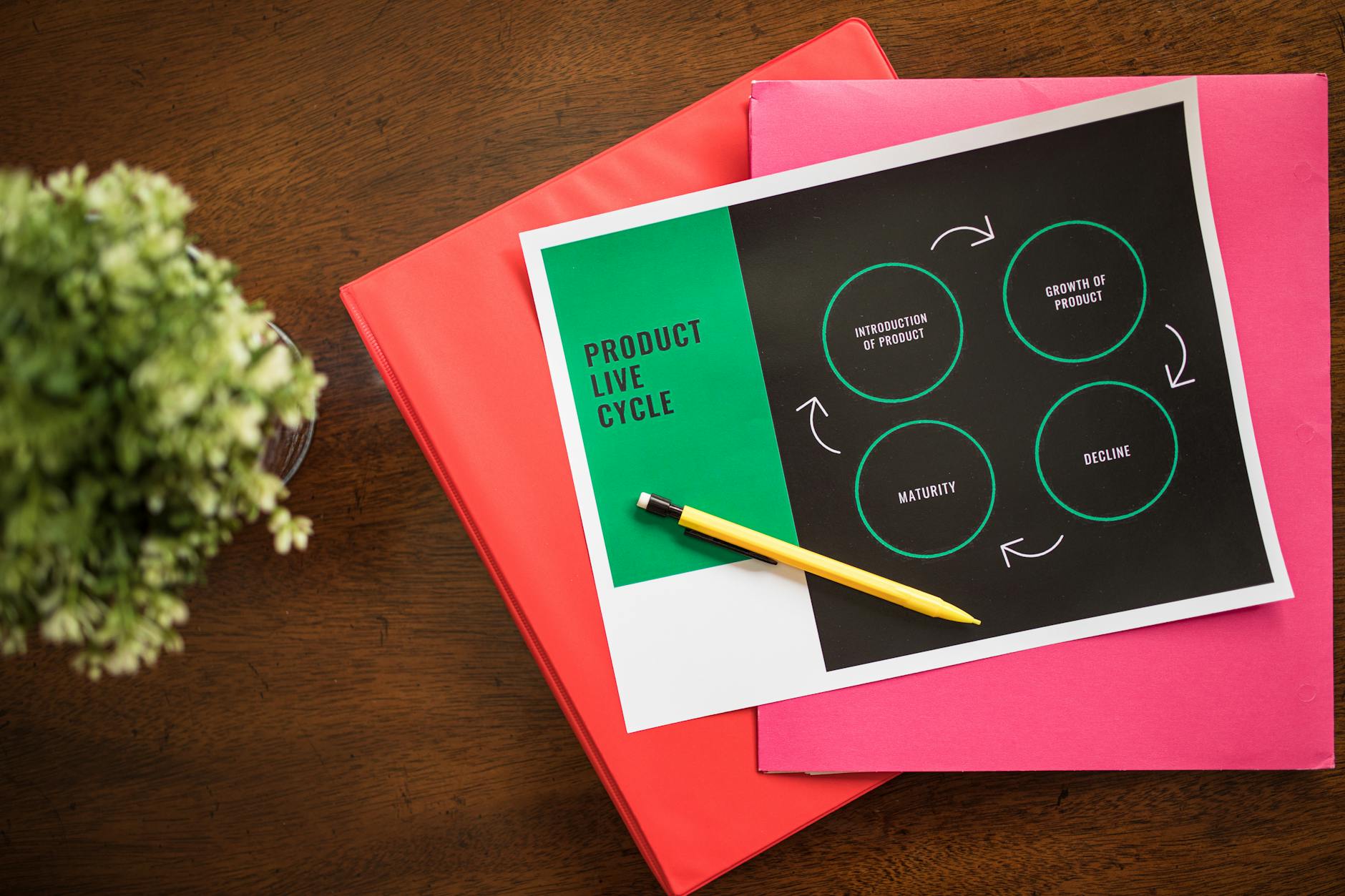

Visualising Long-Term Financial Plans

Long-term planning is similar to conceptualizing a major design project—envision the different stages and end results. Lay out your financial timeline, factoring in scenarios that could impact progress. Advocate for growth by seeking accounts with favorable savings account interest rates to ensure your money works as hard as you do savings account interest rates. Structured planning now means fewer limitations on future creative endeavors.

Explore Income Opportunities

Maximizing Freelance Potential

As a graphic designer steeped in the creativity and energy that swirl around Melbourne's coffee shops in Fitzroy, leveraging freelance work can open up new avenues for income growth. By honing your artistic skills, you not only enhance your portfolio but also make your talent more attractive to prospective clients. Establishing a captivating online presence through a portfolio website or social media can be immensely beneficial. Engaging design principles and showcasing past projects in a visually appealing manner can draw potential clients and signal professionalism.

Diversifying Income Streams

To safeguard financial stability, consider branching out and exploring various income sources. This could involve taking on projects across different design disciplines or even stepping into teaching freelance workshops. Additionally, selling digital products like templates or design e-books online can be a recurring revenue source. Not only does diversification mitigate risks linked to fluctuating earnings, but it also offers a platform to experiment creatively.

Networking for New Projects

Building a robust network is vital in Melbourne's lively creative scene. Attending industry events and joining online communities can expand your professional connections. Engaging with peers can uncover new opportunities and lead to fruitful collaborations. Engage in conversations at local art shows or participate in design-centric meetups to build connections that could lead to future projects.

Embracing these strategies will not only optimize your earning potential but also provide the financial cushioning needed to explore creative ventures like opening a design studio. Balancing excitement and pragmatism is key—keep an eye on transaction accounts to manage cash flow efficiently, and consider integrating a high yield savings account Australia as part of your broader financial strategy.

Savings Strategies for Creatives

Choosing High-Yield Savings Accounts

As a graphic designer manoeuvring through financial aspirations, selecting the right bank account is crucial for optimising your savings. High-yield options can provide a significant edge, especially when irregular freelance income is at play. While sipping on your latte at one of those trendy coffee shops in Fitzroy, consider this—your savings could be steadily multiplying in the background with the right account.

Automating Savings for Consistency

Automating your savings can be a game-changer, allowing you to focus on creativity without the distraction of manual transfers. Think of this as streamlining your financial processes, similar to how you might optimise layers in design software for a cleaner workflow. Consistency in small deposits can accumulate over time, providing the cushion needed for future projects or unexpected expenses.

Comparing Savings Plans

Conduct a detailed comparison of available savings plans using a savings calculator. This tool allows you to input different variables—such as interest rates and deposit amounts—and see how they impact your overall savings. It's like trying out different colour palettes before landing on the perfect scheme for a project. Being informed and proactive with your choices can enhance your financial security, much like how understanding the canvas contributes to a compelling design.

Investment Basics

Understanding Risk and Reward

As a graphic designer balancing creative passions with financial ambition, making savvy investment choices involves understanding the concepts of risk and reward. It’s comparable to selecting the right colour palette for a design project—one wrong move can affect the entire outcome. Investing is not just about throwing money into a venture; it's about assessing how much risk you are willing to tolerate in exchange for potential returns. Low-risk investments like government bonds may offer stability but with modest returns, while higher-risk options such as stocks provide the potential for higher rewards.

Exploring Low-Cost Investment Options

Think of investing as choosing your next design tool—some are more affordable and just as effective as their pricier counterparts. In the financial world, low-cost options like Exchange-Traded Funds (ETFs) or index funds allow you to diversify your investment portfolio without overwhelming fees. These funds are particularly appealing if you're starting and want a balanced approach without unintentionally draining your savings account.

Using Financial Tools and Apps

Being in Melbourne has its perks especially when it comes to tech-friendly solutions—investing can be as accessible as grabbing a coffee in Fitzroy. Financial tools and apps are indispensable for tracking investments and staying informed on market trends. These platforms often feature user-friendly interfaces making it easier to manage your investments whether you’re assessing a high interest savings account or exploring ETFs. By leveraging these tools, you build a more structured path to financial security.

Mastering Financial Management

Keeping an Emergency Fund Ready

I've learned over time the absolute necessity of maintaining a robust emergency fund. It's like setting a graphic design brief where the unexpected can happen, but you're ready for it. Ideally, you want to save up around three to six months' worth of living expenses. This is especially crucial when navigating the unpredictable landscape of freelance work or creative gigs that can be as changeable as the intricate patterns found in the vibrant street art of Hosier Lane.

Visual Expense Tracking

Just like designing a stunning poster for the National Gallery of Victoria, tracking expenses visually can make a huge difference. Tools like pie charts or graphs not only map out where your money goes but also make it aesthetically pleasing and understandable. It's akin to organising layers in a Photoshop file, where clarity is key to successful execution. Merging this with apps that sync up with your bank accounts or credit cards can provide an all-encompassing view of your low interest credit cards debt and tweak expenses accordingly.

Keeping Updated with Financial Trends

As a savvy graphic designer in Melbourne, diving into the latest financial trends or investment opportunities is a bit like frequenting the coffee shops in Fitzroy for a caffeine fix. Always staying in the know ensures adaptability and growth, much like keeping up with the latest versions and features of design software. Reading articles, joining forums, or attending local workshops can provide insights into the ever-evolving market trends, preparing you for decisions as intricate as a meticulously designed digital artwork.